Money

makes the world go 'round & 'round

In the wake of a highly contested U.S. presidential election with an outcome that couldn’t be any more polarizing, it’s important to remember that “money makes the world go ‘round.” This may sound trite or overly simplistic. In life if you follow the money, a lot of things start to make more sense—and eventually, more cents. Some people think money is the root of all evil, but this view is misguided. Growing up, I would hear this perspective a lot at church, yet found it strange that the pastor would pull up every couple of years in a new big-body Mercedes-Benz—a dichotomy that made me curious. If money truly were the root of all evil, then humanity as a whole might as well be a distributed reincarnation of Lucifer. Money is a tool; it should be used as a conduit to bring you closer to the life you want. Money is freedom. We all need it and the majority of us go to work every week in pursuit of it. We shouldn’t vilify this need, instead we should accept this fact. Only then can we start to approach conversations and situations around money from the right perspective.

In, The Revolution Will Not Be Televised (T.R.W.N.B.T) I mentioned that, regardless of this years election results, the United States will not suddenly transform into a utopia, or dystopia—depending on the perspective that guided your ballot on November 5. I say this to remind you that if last week didn’t go as you’d hoped, it’s not the end of the world. On the other side, if it did go your way, you shouldn’t get irrationally optimistic. Politics can be very black or white even though reality’s true color is on the grey spectrum. One thing that can be said however, is that if you deal in, own, or plan to earn money throughout the next four years, you’re in for a good time if you can make the right decisions. Holders of U.S stocks & equities and cryptocurrencies will likely see benefits accrued to them that seem video-game like. I don’t know about you, but I’ll be hopping on the sticks (urban dictionary link for my boomer readers) and I hope you do as well.

Less than seven days after Donald J. Trump was elected the 47th U.S. president, financial markets are showing strong reactions. 401(k)s are soaring, the S&P 500 had one of it’s best weeks of 2024, and with an incoming administration that’s promised to be more welcoming to crypto and technology, it’s 100% clear, the market is responding extremely positive to the GOP winning the House, Senate, and coveted Oval Office. As I’m writing this Bitcoin has just broken through another all time high (ATH) of $80,000. I advised picking some up in T.R.W.N.B.T, and if you did, you’re up right now. If you didn’t, don’t trip—I still believe you have time to build a solid position. Solana (SOL) and Ethereum (ETH) have rallied as well; in fact, the entire crypto market is up right now. The total market cap of all cryptocurrencies is currently $2.74 Trillion USD (according to CoinMarketCap) with many analysts projecting this will reach $10 trillion sometime in late 2025, the time to build that position that’ll be extremely profitable is running out, at least for this cycle. For liability reasons, I have to say that this is not financial advice, but I do want to briefly explain in a few sentences why I’m comfortable allocating a significant portion of my liquid net worth towards stocks and crypto. It’s no secret that the U.S government has a spending problem. At the time of this writing, the U.S National Debt is currently sitting at $35 Trillion dollars (source)

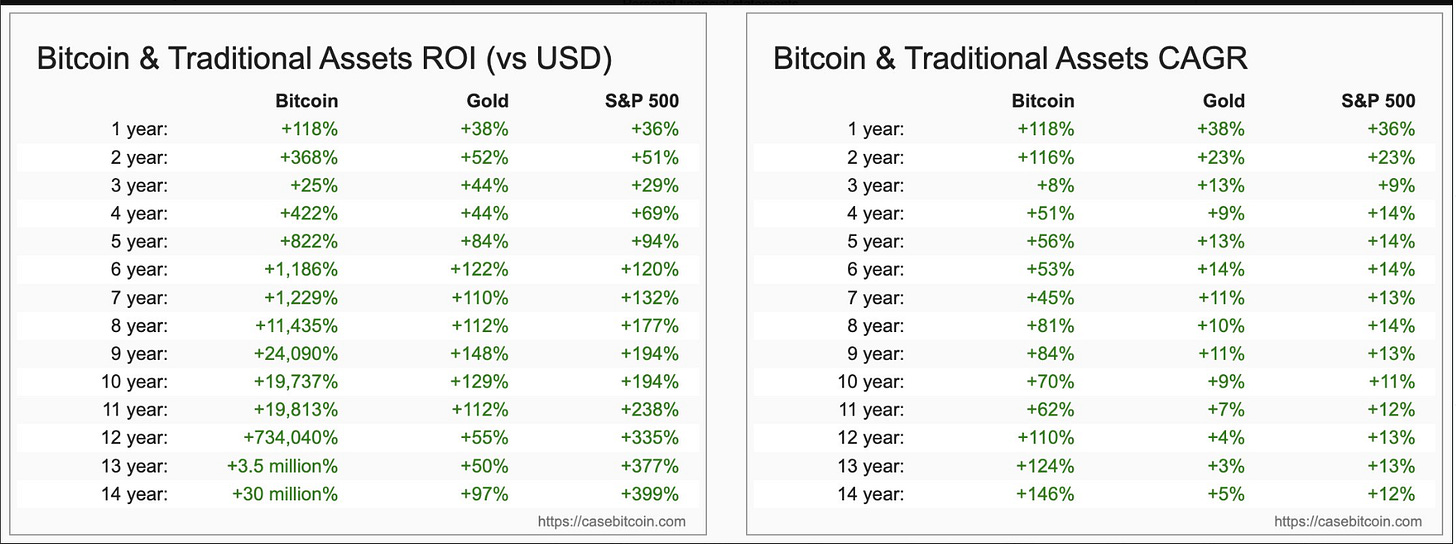

Keep in mind that interest is charged on this amount. What does that mean for the everyday tax-paying American like you & me? It means that our money—U.S dollars—are routinely debased through the U.S Federal Reserve printing (creating) dollars out of thin air. This action combined with the phenomenon of inflation, leads to an environment where our dollars lose real value year after year. So how do smart tax-paying Americans like us combat this? Through investments—namely, stocks and (my personal favorite) cryptocurrency. Check the chart below of Bitcoins (BTC) returns since inception.

Your next question may be, why is crypto performing so well? The short answer is, BTC & other reputable crypto projects serve as a hedge (bet) against the currency debasement that our government must engage in to manage and service our staggering, ever-growing debt. Put even more simply, Bitcoin is digital gold. It’s finite—only 21 million Bitcoins will ever exist, a constraint written and enforced by distributed computer code. Computers are extremely good at doing what they’re told without exhaustion, at least until AGI becomes ubiquitous.

All signs point towards a major bull market in 2025. There’s a simple saying that investors & traders use that describes how one should act in these upcoming fortunate conditions:

When the music is playing, you gotta dance

In other words, when the party is going on, you gotta participate. No one wants to be a wallflower watching everyone else get lit from the sidelines. At least not in a financial sense. I can confidently say that the record player responsible for spinning music during this upcoming bull market is slowly starting to spin.

Maturing for me was giving up on trying to force people to do things that they didn’t want to do. So I’ll only tell you a little bit of what I’m going to do and allow you to do as thou wilt. I’ll be looking to capitalize off strong positions in ETH & SOL, I’ve additionally spent many months in the trenches researching low market cap (low-cap) projects & Memecoins. A few worth checking out that I feel comfortable recommending:

AlienBase (Decentralized Exchange on Base)

$Moodeng (Can’t fade an adorable hippo)

Dogecoin (The meta here is: Elon has shown interest in this coin in the past & there are rumors Trump will appoint Elon to head D.O.G.E, the department of government efficiency) - Whether you hate or love him, you shouldn’t allow that to get in the way of you earning some money$. The play here is clear as day.

Do your research on these and if you need help learning how to purchase and take custody on these, feel free to reach out.