The Revolution Will Not Be Televised

You will not be able to stay home, brother

You will not be able to plug in, turn on and cop out

You will not be able to lose yourself on skag and

Skip out for beer during commercials

Because the revolution will not be televised

Gil Scott-Heron

I Feel Like Paul Revere

Revolutionary change doesn’t happen frequently. When it does occur, it usually isn’t televised—at least not at first. This means if you want to position yourself appropriately to participate in big upcoming societal changes, you should get comfortable getting information from fringe sources, not just mainstream media. Over fifty years ago, Gil Scott-Heron passionately proclaimed, “The revolution will not be televised,” and roughly fifty-three years later, his words still hold truth. Certain types of change can be difficult for us humans to recognize and ultimately accept. Psychologically, our survival mechanisms program us to resist these types of change. If we study the parable of the boiling frog, we can see how easy it is to fall into the trap of reacting to change only after its become too late—a delay that can come at a great cost, to the detriment of the financial, relational, and spiritual aspects of ourselves. When deciding whether or not to embark on a new journey, we should first figure out how much potential this new path has to change our lives for the better. If we decide to proceed, pursuing the end goal with a good heart coupled with genuine desire can lay the foundation for serendipity to bloom. When it comes to fundamentally altering the trajectory of your life, you only need to be right once. In the pursuit of changing your life, I don’t believe there is such thing as failure, but the reality is things can go not according to plans. As with most decisions in life, the duality of risk must be accepted in order to have any lasting success. With that said, failure shouldn’t be feared if the odds are good enough. And when you think about it, after the lesson has been learned, past failures don’t really mean much more of anything. I ask that you keep this in mind as you continue to read the following paragraphs.

From an early age, I was curious about the concept of money. As a kid, this curiosity expressed itself through questions like, “Why do some people have a lot of money, while others who look like us don’t?” This eventually matured into, “How can I learn the unspoken rules, play the game at the highest levels, and make sure I and everyone I care about are properly taken care of?” After I learned and accepted the realities of the world. Years of educating myself on theories of finance would follow, both corporate and personal. Leading to me eventually getting a degree in finance. From there, a short stint working in accounting motivated me to do an on-the-money, (pun intended) career switch into financial technology (FinTech), where I finally felt like I was on the right track. Throughout my life, I’ve used books as gateways to new knowledge and different perspectives, especially on the topics I’m most interested in. A few standouts over the years on the topic of finance:

Books like the ones above fundamentally shaped the way I went about making decisions around earning and spending money. Check them out if you get the chance, I stand by them.

The environment we live in today is filled with varying levels of good and bad information. When it comes to opportunities, some of the best ones arise from situations of knowledge asymmetry—that is, knowing something before it becomes mainstream. This is the highly profitable type of asymmetry I’m mostly interested in when investing in people, places, or things. Currently, the average American may not realize that we’re in the early stages of revolutionary change on our financial system, particularly in how we exchange monetary value digitally. Add to this the real possibility of artificial general intelligence (AGI) approaching soon and it’s clear things are about to exponentially explode.

Reflecting on the words of Mr. Heron, information about such a revolution won’t be immediately found on TV. Right now, this revolution is unfolding within the digital arenas that hold the seams, for our sometimes capricious online social lives, in place. On the surface, it’s not easy to fully intuit—only by a select few, which after reading this essay could be you. Participation won’t be easy as well but will be possible with curiosity and, most importantly, a strong desire to get ahead and succeed. The potential benefits? Completely life-changing. This revolution could facilitate one of the largest wealth transfers in history—and I feel like Paul Revere. If thats interesting to you, you’re in the right place. In the paragraphs that follow, I’ll provide a high-level overview of the situation and, most importantly, information on how you can get involved and start positioning yourself to capture some of the upside, because there will be plenty for those smart enough to capitalize.

The Bail Out

The birth of a revolution is a multi-part process that normally involves one or a series of catalyst events. Those of us fortunate enough to be born in the millennial generation (1981-1996) likely have some type of understanding of The Great Financial Crisis (GFC) that took place between the years of 2007 and 2009. If you don’t, go watch The Big Short for an entertaining overview. I won’t lay out all the details here, but in short, a few of the largest banks in America bit off more than they could chew when it came to speculating on risky mortgage-backed securities. When these bets blew up, metaphorically, these banks were caught with their pants down. By 2008 most of their financial positions were in the red and the writing was on the wall, kicking off a chain of events that almost collapsed our financial system at the time. Millions of Americans lost their homes in foreclosure. Over 8 million people lost their jobs. And oddly enough, only a couple out of the many, Wall Street honchos responsible got exposed as charlatans as a result of all the fallout. Many people, myself included, believe that the leaders at these banks weren’t fully held accountable for their insatiable appetite for profit by any means necessary. As more details emerged, it became clear that without financial assistance from the U.S Government, these distressed banks would likely have gone bankrupt. Had that happened, bank runs across the country would have surely followed from all the fear and paranoia. If that had occurred, an economic downturn not seen since the times of the Great Depression would have been almost inevitable. The term “Too Big To Fail” became infamous around this time. Some even believe the banks knew what was going on all along, as in deep down they knew the government would cover their positions had their original parlay-like bets not played out beneficially. The saying “money makes the world go round” may be a cliché, but in this scenario, it’s very true. If we were to personify America, these banks would be its heart. Responsible for pumping trillions of dollars throughout the U.S & global financial systems we rely and build our lives on daily. If this had failed, you can imagine the chaos that would have ensued, and if you can’t, go watch The Purge. So it was true, these banks were too big to fail, and a bail out had to happen, whether the U.S Government was happy to facilitate it or not. What didn’t sit right with me, as well as millions of other Americans, was the fact that the people responsible for getting us into the situation were likely going to escape mostly unscathed. Like Richard Fuld, who was CEO of Lehman Brothers at the time—he walked away with millions and did not face criminal charges for any contributions he made towards the crisis. In the aftermath, only minor regulations were enacted, such as requiring banks in the future to hold more cash on their balance sheets to offset the risks of the popularized fractional reserve banking system that so many banks use today. Realizing that the people responsible for creating the crisis, many of whom received compensation packages in the nine-figure range, had to rely on the government to bail them out of a situation they created seemed strange and further compounded my growing belief at the time that the system was rigged.

That wasn’t even the worst of it though—it gets better. After it came to light that the U.S government essentially got finessed into bailing the banks out, the American people soon learned that their dollars would be involved as well. Uncle Sam (who I’m sure you know quite well by now) was brought in to help cover a portion of the bailout. After this, it was clear that some type of change was needed. But before that would happen, the Fed did what it does best and got the money printer primed and ready. It’s said between 2008 and 2014 over $3.5 trillion U.S dollars were printed by the Quantitive Easing (QE) Program created for the bail out(source,source). QE, in laymen’s terms, is simply U.S dollars being created out of nothing and being injected into the financial system. Note that the dollar is a fiat currency, meaning it’s not backed by gold or any other precious material. It’s also important to point out that historically, fiat currencies have not performed well over time; many eventually failed, bringing empires down with them. Study the demise of the Roman Empire’s denarius (which was debased with fake silver) as an example.

Another way to look at what the Fed did, and continues to do to this day, is to imagine you’re playing monopoly as the banker. Not only do you use the money you have, but you also use money from the bank’s stash at will. By having direct access to unlimited, free monopoly bucks, you devalue the buying power of all of the other players, as someone (you) is in the game with an unfair and unnatural amount of buying power flooding the market. In this scenario, a rising tide does not lift all boats in a positive way. As an aside, this, along with some other factors, is why its a common recommendation to never let your greenbacks just sit in a regular checking or savings account provided by the popular big banks. They won’t pay you jack in interest to offset the natural rate of inflation. That means year over year, you’re losing money when your dollars sit in these low-interest-rate accounts. No bueno—over here we preach the gospel of making our money work for us not against. If you’re in this situation right now, stop what you’re doing and open up a High Yield Savings Account (HYSA) stat. (link)

As the money printer began churning out dollars, activists from around the country began discussing on social media brainstorming what a better financial future for the American people might look like. During this time, the seeds that would give birth to the Occupy Wall Street movement, which arrived in September 2011, were planted. Simultaneously, another group was working on a solution, fueled by a cypherpunk ethos. The goal was to empower the people. As the crisis reached its crescendo in the fourth quarter of 2008, they were ready to enter the ring to fight for change as well. On October 31, 2008, the bitcoin whitepaper released online. Shortly after, the Bitcoin blockchain officially launched on January 3, 2009. Initially not many people knew or cared about Bitcoin, and it stayed that way for almost a decade after its release. In the beginning it was mostly internet nerds and users of the message board bitcointalks.org. Bitcoin’s creator was credited to an anonymous moniker, Satoshi Nakamoto. Whether it was a singular person or a group who wrote the open-source code that powers the bitcoin network is still a mystery to the general public, even in present day. Satoshi has remained completely anonymous. At this point, I’m unsure if we’ll ever find out. Whoever they are, it’s safe to say they, like many others, took noticed the ills of the financial system at that time and decided to offer people an alternative. The original goal of Bitcoin was to be a peer-to-peer (P2P) money system, free from the control of any financial or governmental institution. The first few sentences of the whitepaper read:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Over 14 years later, Bitcoin has steadily grown to become more well known in popular culture. In the years following 2009, thousands of other cryptocurrencies were created, with a select few, such as Ethereum and Solana, finding product-market fit similar to Bitcoin. I’ll do deep dives into each of these in future posts so stay tuned for that. At the time, it wasn’t immediately clear that the anonymous release of Bitcoin under the shadows of Halloween in 2008 would be the catalyst to kick off a new asset class called cryptocurrency. Bitcoin came with properties that allowed for it to exist and operate outside the controls of any one government, it was decentralized and, at it's core aspiringly democratic. Properties that many say are fundamental to any system of value that can stand the test of time. When things hit rock-bottom often enough, new ideas and solutions are birthed that attempt to rise to the call of being better than their predecessors. This is true not only for revolutions but everything in life. A decade later, it appears crypto has found it’s footing and is ready to go fully mainstream. Today, a growing group of people know or have heard about what crypto is but aren’t actively participating in the community or have that much of an interest to do so—except for when prices hit new all-time highs. Not knowing that when that happens, it’s the worst time to invest. The mainstream media paints crypto as being filled with scams and degenerate gamblers who party too much and spend thousands on online digital pictures called NFTs. But I’m here to tell you that it’s way more than that. Real financial innovation is going on if you willing to look past all the surface-level noise. Behind the scenes, a new system is being built—one that in the future will become as ubiquitous as the internet.

Once Bitten, Twice Shy

The bailout happened over a decade ago, yet we’re still feeling its effects today. It wouldn’t be a stretch to say that the last five years have been challenging, both psychologically and financially. A global pandemic that killed millions, the lockdowns that followed, lives and families destroyed, resulting in relationships fundamentally changed forever. If I’m keeping it real, things just haven’t felt right since we lost Nipsey Hussle and Kobe Bryant, especially in Los Angeles—but thats a topic for another time. Without a doubt, life as we knew it pre-pandemic looks very different from life post-pandemic. On the financial side, we’ve had to deal with historically high levels of inflation, peaking at around 9% in the summer of 2022(source). This paired with a constantly rising Consumer Price Index (CPI), which was roughly 22% higher in June of 2024 than it was in January 2020. It’s safe to say, shit done got more expensive, and no matter where you fall on the wage spectrum, you’re most likely feeling it in one way or another.

Going back just a few decades the idea of the America dream seemed like a rite of passage. Today, it’s more like a meme—something you say tongue-in-cheek, likely to be met with eye rolls and growing levels of apathy if you’re preaching its realistic attainability to the average person. Millennials and Gen Z alike are grasping at anything to keep them afloat, and unfortunately, not much time is left to possibly get ahead, at least in a traditional sense. So what options do we have? The two that are most obvious to me are artificial intelligence and cryptocurrency. Stick with me—I’m not saying that you need to become a full-fledged AI engineer or cryptocurrency trading expert. What I’m saying is that these two new and rapidly growing industries are going to spur radical change in all areas of our lives. At this early stage, developing just a moderate level of understanding and making a few smart investments in viable projects will bring enormous benefits to your life.

Three months out from another presidential election, it’s clear people are looking for change. No matter what side of the coin you’re on, I think it’s important to remember that after the election day, America isn’t going to turn into a utopia overnight filled with all the promises that either politician is pushing right now. Meaning if we want true change, we’re most likely going to have to rely our ourselves for the majority of it. There's never been a better time to position yourself to capitalize on where technology will likely take us as a civilization over the next couple of decades.

There’s a saying that I really like:

Hard times create strong men. Strong men create good times. Good times create weak men. Weak men create hard times.

If we’re in hard times, then what we really need right now is strong men and women who step up to the challenge of bettering themselves, thereby indirectly bettering those around them and progressively improving the state of our country. If that sounds overly simplistic, it’s because it is. Oftentimes, the most complicated problems can be solved with a simple solution. Spending years working on financial systems responsible for moving millions of dollars per month has taught me that. One key requirement for bettering yourself, however, is ensuring you have the financial means to do so. It’s a common trope that money doesn’t change you; it just makes you more of who you already were deep down inside. I somewhat agree with that, but the truth is, you can’t begin to facilitate lasting change in your life when you’re worried about where your next meal is going to come from. It’s very hard to get a bird’s-eye view of any situation when you’re stuck in the trenches. In this increasingly digital world, I think it’s important to consider what life may be like 5-10 years from now and start to position ourselves accordingly.

When it comes to artificial intelligence, the cat is out the bag, and it’s not going back. If you haven’t played around with ChatGPT by now, you’re behind the curve. The AI arms race is in full swing, and trillions of dollars will be spent by companies in pursuit developing the best large language models (LLM). Companies like OpenAI, Google, and Meta are swinging for the fences. How can you position yourself to make sure you’re up to speed? Find ways to utilize ChatGPT in your daily workflows, don’t just type in a question—try talking to it. Tell it your problems. For example…

“I need a diet and workout program that will help me gain 10 pounds of muscle in the next 6 months, I want to workout no more than 6 days a week and I currently weigh 190 pounds and am 6’2 tall. I want to eat 4000 calories a day.”

It’ll provide a detailed workout plan with rep counts and diet recommendations, including macro breakdowns. That is just the tip of the iceberg for what AI can currently do and the crazy part is, the capabilities are growing at an exponential rate. A practical understanding of AI will become necessary to stay competitive in the future. Keep an eye on tools such as Sora and Google’s generative AI suite of tools.

One truth about the passage of time is that things never stay the same—change is the only constant. A hundred years ago, the period from 1920 to 1929 was defined as “the Roaring Twenties.” This slice of American history was known for birthing great economic prosperity as well as large advancements in fashion and music like the Harlem Renaissance. One hundred years later, It’s clear that the Roaring Twenties we’re living through today are going to be quite a bit different. As the economic landscape grows increasingly difficult, I think the time is now to look beyond traditional financial systems for a way to revive the elusive American Dream. Enter cryptocurrency—a digital wild west where fortunes are made and financial freedom is no longer just a pipe dream. In a world where banks and governments have struggled to keep inflation in check, crypto offers a decentralized escape hatch, a way to sidestep the old guard and take control of a new version of your financial destiny. Independence, lower fees, fast transaction times and a hedge against the dollar’s decline are some of it’s promises. Crypto isn’t just a currency; it’s a movement. For those who feel left behind by the rising cost of everything from gas to groceries, digital assets represent a shot at reclaiming the sense of opportunity that once defined America. In this revolutionary new world, the American Dream isn’t dead—it’s just been reimagined on the blockchain.

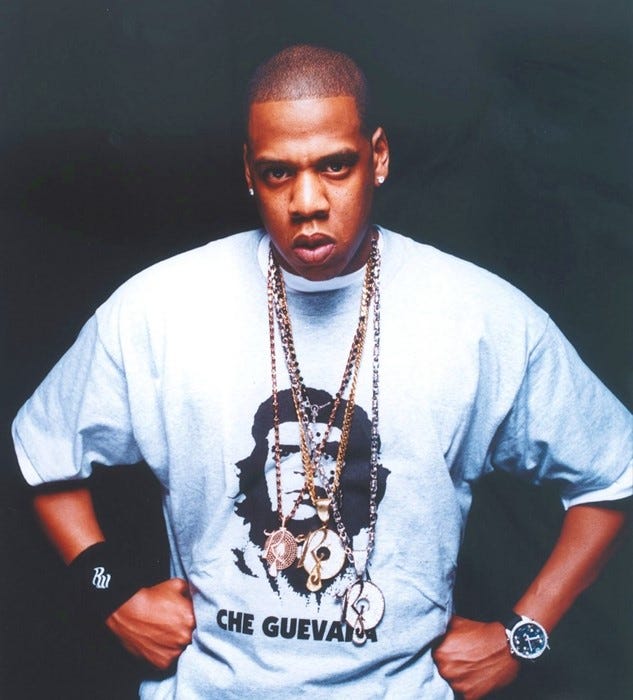

Che Guevara With Bling On

One of my favorite Jay-Z songs is “Public Service Announcement.” - In it, there’s a bar that always catches my ear:

“I’m like Che Guevara with bling on, I’m complex.”

Che Guevara was a prominent figure who rose to power and played an important role in the Cuban revolution, between 1953-1959. Like a lot of revolutionaries, he died relatively young while fighting for what he believed in. Since his death, his face has gone on to become a symbol of rebellion and resistance against authority. If there’s one thing Jay-Z is great at, it’s writing a line that, on the surface appears simple, but when examined more closely, is really linguistically layered. The story behind this line comes from Jay’s 2003 MTV Unplugged performance where he wore a Che Guevara shirt with a platinum chain around his neck. A journalist who was covering the event, Elizabeth Méndez Berry, wrote about it afterwards stating,

When he rocks his Guevara shirt and a do-rag, squint and you see a revolutionary. But open your eyes to the platinum chain around his neck: Jay-Z is a hustler.

Although Jay’s life didn’t end violently at a young age as did Guevara’s. When I think of both men, I see two revolutionaries, each in their own respective ways. Che for social & political reasons, Jay for revolutionizing hiphop by bringing it to the mainstream and succeeding in a system where not many people who look like him achieved success. The idiom “the first guy through the door is most likely to get shot” describes the inherent risk taken by pioneers of new movements. Luckily for us, it is often the second and third cohorts of people behind them who reap the most benefits. I bring up the stories of these two men to highlight the fact that, although we may not go down in history books as Guevara & Jay, we can still play pivotal roles in advancing the change we want to see in the world. The change that I want to see is a world where more people are empowered financially, resulting in them being able to better themselves if they so chose to do so. We live in a time where you can practically learn anything on the internet; the only challenge is filtering out the good from the bad information. Why not spend a couple hours each week to ensure your financial viability for potentially generations to come?

In closing I’ll explain why I think now is the best time to get some crypto exposure. Let me caveat this with, I’m not suggesting you should go take a loan out on your mortgage or engage in other extremely risky financial activities to invest in crypto. I usually advise friends to start with an investment of between 2-5% of your net worth, especially if you’re young under 45 years of age. Begin by investing in blue-chip cryptocurrencies, such as, Bitcoin, Ethereum, and Solana. Hold off on purchasing any NFTs as these require a lot of ecosystem dependent knowledge to really make prudent decisions, and the liquidity of NFTs isn’t as high as that of regular tokens.

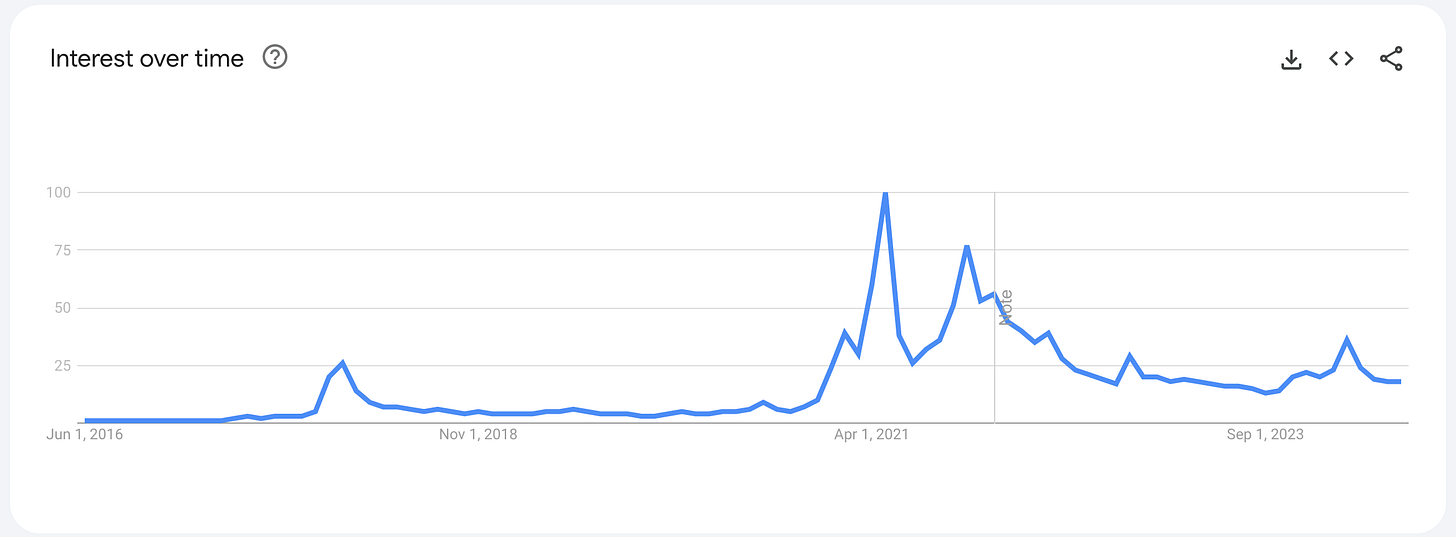

Below is a google trend graph representing frequency of global search history on the term “crypto.” This graph depicts the clear hype-cycles that crypto has gone through, starting with a small one in 2017 and an much larger increase in mid-2021. One thing to note is that every cycle is exponentially bigger than the previous one, and after the hype has died down, the new status-quo maintains a higher baseline than before. Many are saying we’ll see a similar explosion after the election going into 2025.

If you’ve made it here, I appreciate your attention. I hope I’ve done a good job of piquing your interest in the opportunities available in crypto space. If you’re completely new, below I’ll list a few things you should do to start your journey and get your feet wet. It’s important to remember that one of crypto’s prominent ethos is self-reliance. If there is one piece of advice I can give you on your journey, it would be to always ask questions, avoid getting too emotional, and I would be wrong if I didn’t mention a common saying thrown around this space: Do Your Own Research (D.Y.O.R)

Steps

Sign up for a Coinbase Account using my referral link here

Sign up for X/Twitter and follow these accounts (Information in crypto moves fast, ‘crypto twitter’ is the term used to describe the information community of prominent voices in the space)

Utilize Coinbase Earn to take short quizes that pay you in crypto. Earn up to $118 here

Subscribe to this newsletter below (I’ll be releasing a steady stream of my insights on crypto developments and my overall investment thesis on an ongoing basis)

Bonus: follow me on twitter where I’ll routinely share my thoughts on crypto and life - https://x.com/jahoshuma

Extra extra bonus: purchase any amount of (Bitcoin, Ethereum, or Solana) on Coinbase & join the revolution. (first person who completes this and sends me proof, I’ll send $50 in BTC)

Lastly, It’s important to remember that with crypto investing, you get out what you put into it. This isn’t a get-rich-quick scheme and I truly believe in order to make smart decisions, you need to have a baseline understanding of the financial and technological challenges that cryptocurrency aims to solve. For liability reasons, I must caveat this entire essay with saying nothing I said here is financial advice, before making any serious decisions, (D.Y.O.R).

This Newsletter

If you enjoyed this writing, subscribe to be updated on future posts. If you have any questions feel free to reach out. 🫡